The Future of EV Batteries: CATL, LG, BYD, and Samsung

Introduction

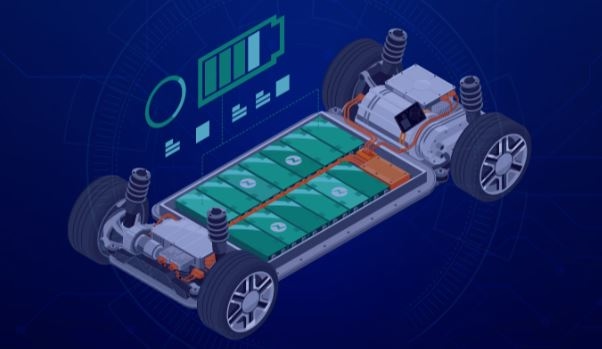

As the demand for electric vehicles (EVs) accelerates, the battle for electric vehicle battery supremacy intensifies. Four key players—CATL, LG Energy Solution, BYD, and Samsung SDI—are leading the charge, each with its unique approach to advancing EV battery technology. From BYD's Blade Battery to CATL's lithium iron phosphate (LFP) cells, let's explore the innovations, market positions, and regional strategies driving these battery giants forward.

1. CATL: A Global Leader in Battery Innovation

Technological Advancements

CATL (Contemporary Amperex Technology Limited) has established itself as a dominant force in the battery industry, leading the way in energy density improvements and the development of new battery chemistries. The company’s flagship Shenxing and Qilin batteries are game-changers, featuring enhanced margins and wide adoption within the EV sector. CATL has primarily focused on LFP battery technology, which strikes a balance between cost-efficiency and energy density, making it an ideal choice for mainstream electric vehicles. This technology is also more resistant to fire, providing added safety for EV owners.

Growth Strategy

As part of its international growth strategy, CATL is targeting new markets beyond electric cars, such as machinery and shipping—industries that are just beginning to adopt electric vehicle battery solutions. These sectors represent untapped potential and align with CATL's commitment to technological innovation.

Regional Strength

- China: Dominates the domestic EV battery market with strong governmental support.

- Europe: Expanding its presence, with the Hungarian plant positioning it to meet rising demand for EV batteries in the region.

2. LG Energy Solution: Diversifying to Stay Competitive

Technological Advancements

LG Energy Solution (LGES) is banking on LFP battery technology to capture a larger share of the entry-level EV market. One of its recent innovations is the development of cell-to-pack (CTP) technology, which eliminates the need for battery modules, improving manufacturing efficiency. This not only reduces costs but also allows for higher energy density, which can translate into better performance for electric vehicles.

Growth Strategy

Faced with fluctuating demand, LGES has shifted its focus from expansion to optimization. The company is prioritizing its existing production capabilities while leveraging IRA incentives to boost its standing in the US market. Long-term partnerships, such as with Renault, are helping LG maintain a competitive edge in Europe, but scaling up production remains a challenge.

Regional Strength

- United States: Benefiting from the IRA and maintaining strong relationships with US automakers.

- Europe: Focusing on long-term contracts but contending with slower market growth and competition from CATL battery and BYD battery manufacturers.

3. BYD: Leading the Affordable EV Revolution

Technological Advancements

BYD is making significant strides in EV battery technology, particularly with its Blade Battery. This innovative design offers increased energy density while maintaining high safety standards, addressing concerns about thermal runaway, a common issue in other lithium-ion batteries. In addition, BYD’s fifth-generation DM hybrid system boasts 46.06% thermal efficiency, enabling a remarkable combined range of up to 2,100 km—setting a new standard for hybrid performance.

Growth Strategy

BYD's strategy includes focusing on both the luxury and mainstream markets. Its high-end models, such as the Yangwang U8, aim to capture the ultra-luxury EV segment, while its affordable offerings dominate in emerging markets. The company is also building overseas plants in Thailand and Brazil to strengthen its global supply chain and reduce export dependency.

Regional Strength

- China: A dominant player in the domestic EV market.

- Southeast Asia and Latin America: Leading the charge in the transition to affordable electric vehicles, capitalizing on rising demand for cost-effective EV battery solutions.

4. Samsung SDI: Premium Focus with High-Density EV Batteries

Technological Advancements

Samsung SDI is primarily focused on increasing the energy density of its EV battery cells, making them suitable for premium and luxury vehicles. The company is also exploring next-generation technologies, including solid-state batteries, which could significantly improve both range and safety in future electric vehicles.

Growth Strategy

Rather than chasing volume, Samsung SDI is focusing on optimizing its existing production processes while expanding partnerships with luxury automakers. The company is also eyeing opportunities in the energy storage system (ESS) market, which represents a growing sector beyond electric vehicles.

Regional Strength

- Europe: Strong relationships with premium automakers, giving Samsung battery a foothold in the luxury EV market.

- Asia: A solid base of operations, although facing increased competition from CATL battery and BYD battery solutions.

Summary Table: Key Insights

| Company | Technological Focus | Growth Strategy |

|---|---|---|

| CATL | High energy density, LFP batteries | Expansion into machinery and shipping sectors; new Hungarian plant in 2025 |

| LG Energy Solution | LFP, cell-to-pack (CTP) technology | Shifting from growth to optimization; leveraging US IRA incentives |

| BYD | Fifth-generation DM hybrid, Blade Battery | Focus on luxury and mainstream markets, expanding global manufacturing presence |

| Samsung SDI | High-density EV battery cells, solid-state tech | Expanding premium partnerships, exploring energy storage systems (ESS) market |

Conclusion: The Race for EV Battery Supremacy

The competition in the EV battery market is fierce, with CATL, LG, BYD, and Samsung SDI leading the charge through innovation, strategic partnerships, and regional expansion.

- CATL continues to lead in both technological innovation and market share, particularly in China and Europe.

- LG is focusing on optimizing its existing capacities while navigating challenges in scaling production in the US and Europe.

- BYD stands out for its rapid growth in global markets, offering both affordable and luxury EV battery solutions.

- Samsung SDI is carving a niche in the premium segment, focusing on energy-dense electric vehicle battery solutions for luxury cars.

As the EV battery market continues to evolve, these four companies will undoubtedly play pivotal roles in shaping the future of electric mobility. Whether you're interested in BYD's Blade Battery, CATL's LFP technology, or Samsung's solid-state innovations, these companies are driving the next wave of technological breakthroughs in the EV space.